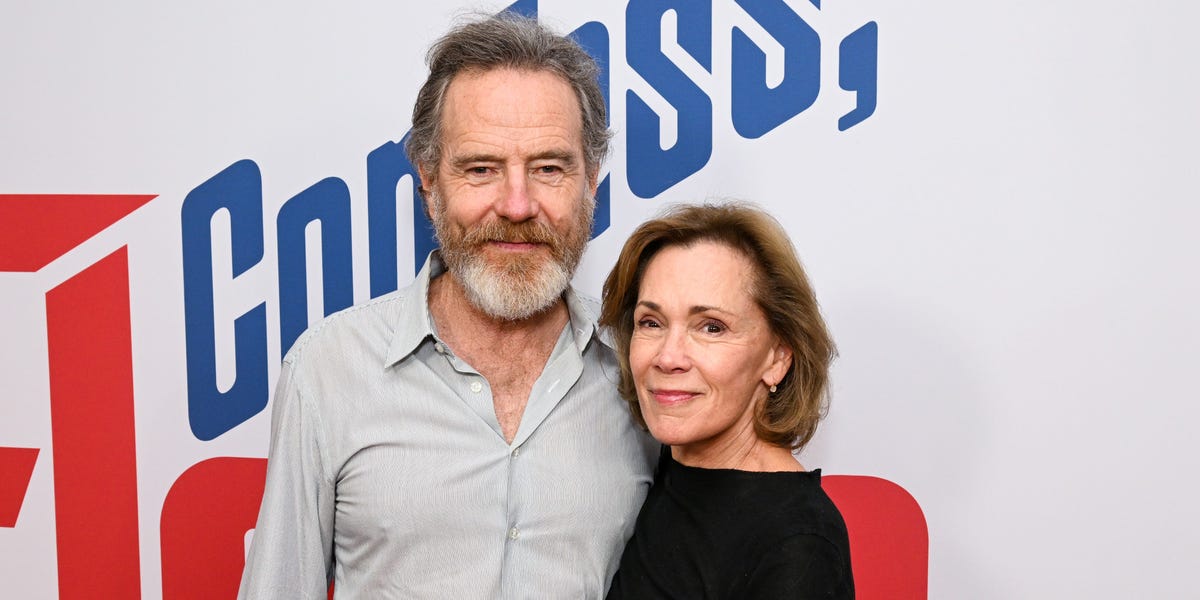

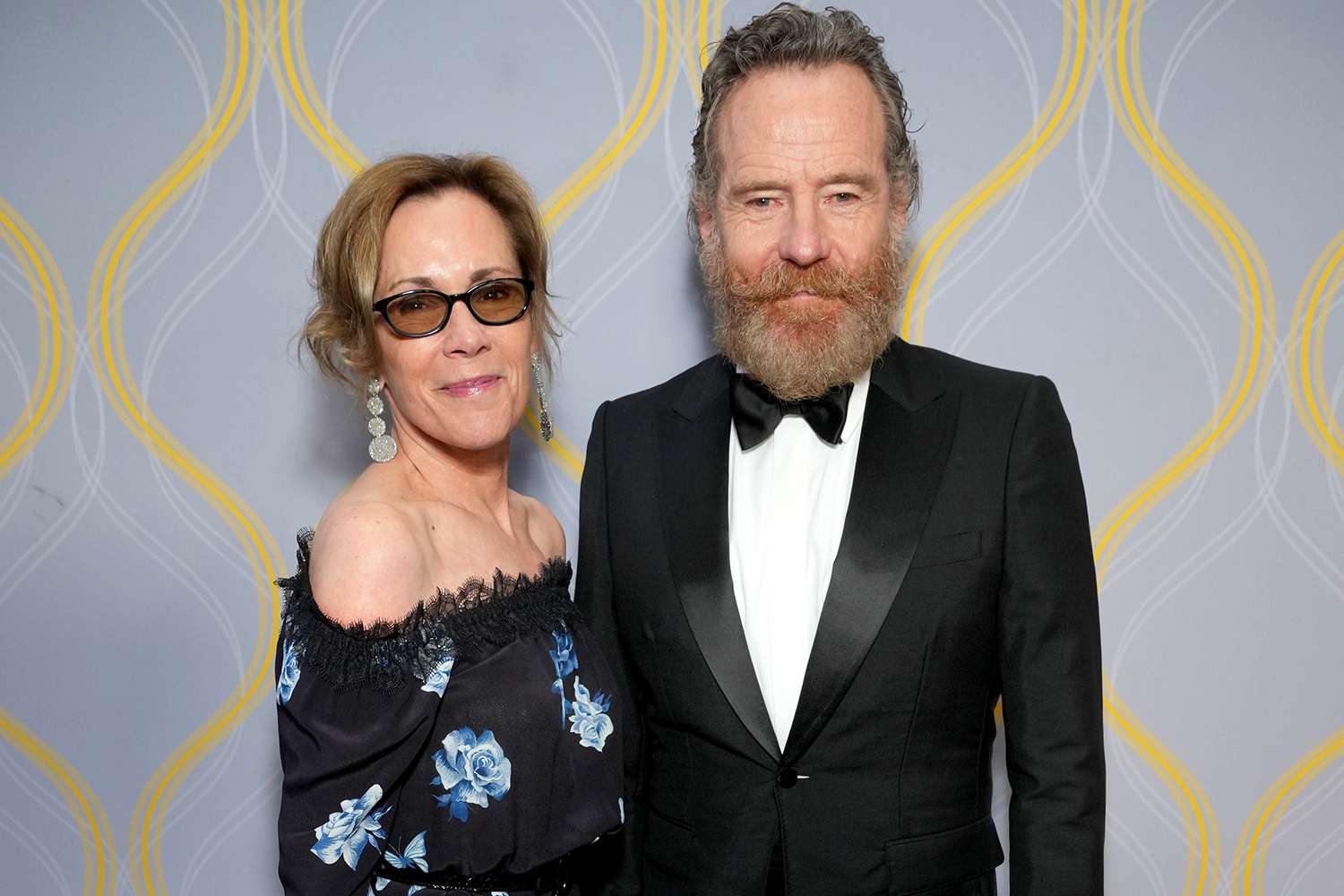

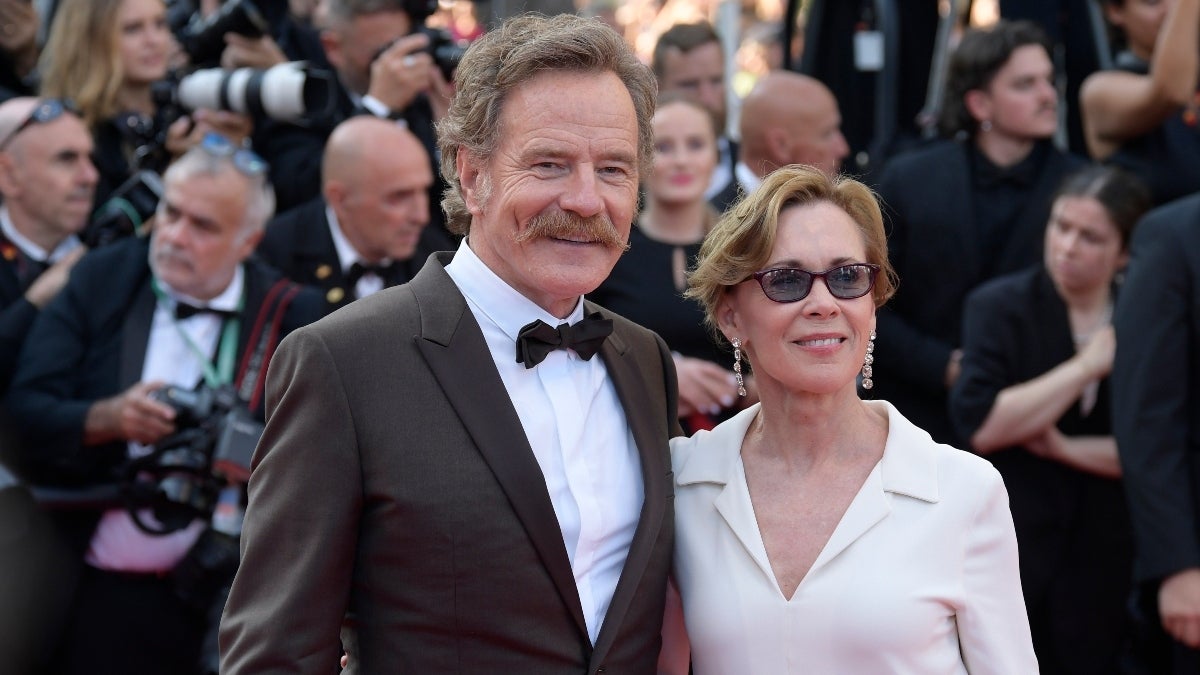

Bryan Cranston, the celebrated actor who played the iconic character of Walter White on “Breaking Bad,” has announced that he intends to retire from acting in 2026. In a recent interview, he stated that he wants to “level out” his marriage with his wife, Robin Dearden, with whom he’s been since 1989. Cranston added that he wants to experience life in a quaint French village and soak up the local culture, language, and food once he retires from his legendary acting career.

The Reason for Retiring

Cranston revealed that the reason for retiring from acting is that he wants to bring balance to his wife’s life. For the last 24 years, Robin has led her life holding on to Cranston’s tail and has had to adjust her life based on his schedule. Cranston, determined to level out their life balance, plans to retire in 2026.

Cranston’s Retirement Goals

Retiring from acting doesn’t mean that Cranston will stop living life. He plans to move to France with his wife and experience life in a French village. Cranston hopes to “change the paradigm” of their marriage and spend time with his wife of 30 years. The lovebirds plan to drink wine, relax by the fire, have day trips, and not read scripts. This change will give his wife, Robin, the chance to lead her life as an independent woman and live her dreams.

Selling his Other Businesses

Cranston isn’t just retiring, but he also plans to sell his businesses. Cranston co-founded a mezcal company called Dos Hombres with his “Breaking Bad” co-star, Aaron Paul. The company will be sold during his retirement. Moonshot Entertainment, his production company, will also be shut down as part of his retirement plan.

The Malcolm in the Middle Reunion

Cranston’s retirement may give his fans a chance to see him on screen once again. Cranston hopes to revive “Malcolm in the Middle” as a reunion. The veteran star wonders what happened to the family 20 years later, where are they now? What are the kids doing? It’s a series that we would love to see come to fruition and learn what happened to the family after they grew up.

Tips for Getting Ready to Retire

Start planning early

The earlier you start planning for retirement, the better. This way, you can make informed decisions and adjust your lifestyle to prepare for your golden years.

Communicate with your partner

It is essential to involve your partner in your retirement plans. This way, you can both make decisions that will affect your life together and accomplish your retirement goals.

Save enough money

You need to start saving money towards your retirement, as you don’t want to live in penury during your golden years. Evaluate your expenses and what you need to maintain your ideal lifestyle in retirement.

Invest your money wisely

Investing your money in stocks, bonds, or mutual funds wisely can give you the best chance of growing your savings and having a good retirement account in the future.

Create a lifestyle plan

Once you retire, you might be spending more time at home than before. You can create a lifestyle plan that will ensure you have enough activities to keep you busy and active in retirement. Think about going back to school, taking up a hobby, or traveling to new places.

Conclusion

In conclusion, Cranston’s retirement plans are all about his goals of bringing balance and a new experience to his life and that of his wife. Retirement is not something that should be taken lightly, and there are tips and steps you can follow to be well-prepared. Whatever you do to prepare for your golden years, ensure that you plan and save enough to live comfortably and achieve your retirement goals.

FAQs

1. Is it necessary to communicate with your partner when planning for retirement?

Yes, involving your partner in your retirement plans is essential. This way, you can make decisions that will affect your life together and accomplish your retirement goals.

2. What are the tips for getting ready for retirement?

The tips for getting ready to retire include planning early, communicating with your partner, saving enough money, investing wisely, and creating a lifestyle plan.

3. How can I save enough money for retirement?

You can begin by evaluating your expenses and determining what you need to maintain your ideal lifestyle in retirement. You should also plan to start saving early and look for investment opportunities that offer a good return on your investment.

4. How can I invest my money wisely for retirement?

You can invest your money in stocks, bonds, mutual funds, or various other investment options. The key is to invest wisely and not put all your eggs in one basket. Consider diversifying your portfolio to mitigate risks and ensure your investment is sustainable long-term.

5. Why is it necessary to create a lifestyle plan for retirement?

Having a lifestyle plan can help you stay active and avoid boredom in retirement. You can plan activities that keep you busy, such as traveling, taking up a hobby, or going back to school.