safe

Industry Updates and Insights

ACORD’s Unified Life Insurance Application

ACORD, the standards organisation for the global insurance sector, has released a unified life insurance application aimed at enhancing efficiency and accuracy for both insurers and distributors.

This application, now approved by the Interstate Insurance Compact for pre-filing across 47 states, marks the first standardised form of its kind. The new format is expected to improve customer experience, simplify underwriting, and quicken regulatory approval times.

With this standardised application, customers and distributors can apply for policies with any participating life insurer through a single, universal form. Developed through extensive collaboration between ACORD, life insurance distributors, carriers, and the Interstate Insurance Compact, the application is designed with a digital-first approach to address common industry challenges, including customer dissatisfaction and labor-intensive review and approval processes.

“Standardising the data collection process is a critical first step in enabling next-generation digitalised underwriting,” added ACORD CEO Bill Pieroni. “Providing a standard data structure from the outset of the application process directly leads to more efficient use of data across the value chain – from enabling automated screening by underwriting rules engines, to creating a more consistent digital experience for customers shopping for the most suitable policy.”

All questions in the application are crafted to reduce bias and ease customer frustrations. They focus on information that is straightforward for customers to provide and essential for underwriting decisions.

Carriers maintain the flexibility to modify or omit questions to align with their specific underwriting guidelines, without affecting the expedited approval process made possible by the ACORD application’s pre-filed status with the Interstate Insurance Compact.

“A standard life application will greatly simplify the producer’s role and the client’s experience, especially when they are applying for multiple policies,” commented ACORD Standards Project Group Chair Andy Kramer (VP Underwriting Risk and Innovation, M Financial Group). “The producer can more accurately describe the questions that will be asked and avoid missing questions that will delay the underwriting and approval process. It should also greatly reduce the implementation and ongoing maintenance costs incurred by carriers once this application is enabled in the application platforms.”

Industry Reactions and Perspectives

Quotes from Industry Leaders

“Standardising the data collection process is a critical first step in enabling next-generation digitalised underwriting,” added ACORD CEO Bill Pieroni. “Providing a standard data structure from the outset of the application process directly leads to more efficient use of data across the value chain – from enabling automated screening by underwriting rules engines, to creating a more consistent digital experience for customers shopping for the most suitable policy.”

“A standard life application will greatly simplify the producer’s role and the client’s experience, especially when they are applying for multiple policies,” commented ACORD Standards Project Group Chair Andy Kramer (VP Underwriting Risk and Innovation, M Financial Group). “The producer can more accurately describe the questions that will be asked and avoid missing questions that will delay the underwriting and approval process. It should also greatly reduce the implementation and ongoing maintenance costs incurred by carriers once this application is enabled in the application platforms.”

Cyber Insurance Market Developments

Ransomware Claims and Industry Loss Ratio

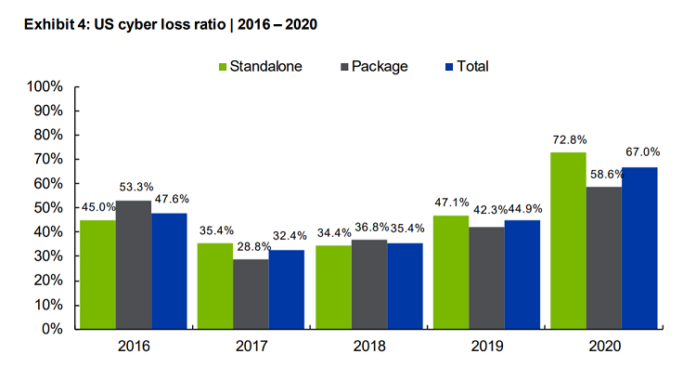

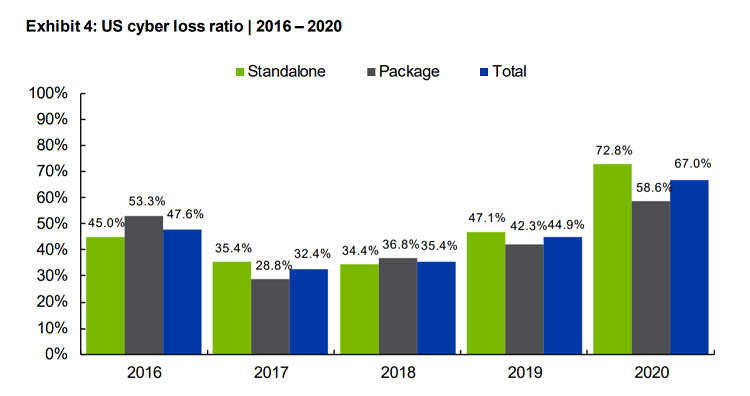

A new report on the US cyber market by re/insurance broker Aon shows that the overall industry loss ratio jumped up by 22.0 percentage points last year to reach a record high of 67.0%.

Analysts attributed that increase primarily to the growing severity of ransomware claims, which included heightened incident response costs and extortion demands.

Aon’s US Cyber Market Update found that both the Standalone and Package segments saw their highest loss ratios since data collection began in 2015, with Standalone cyber policies recording a 25.7 percentage point increase (from 47.1% to 72.8%), and Package policies a 16.4 percentage point increase (from 42.3% to 58.6%).

The 2020 loss ratio increase appears to be primarily due to an increase in claim severity, as the average claim size rose more than 50% from $48,709 in 2019 to $74,354 in 2020.

Cyber Insurance Premiums and Rates

US Cyber Insurance Direct Written Premiums

US cyber insurance direct written premiums totalled $2.74 billion in 2020 – an increase of 21% over the $2.26 billion recorded in 2019 across both Standalone and Package products.

This also means that premiums have more than double over a five-year period, given that 2016 premiums totalled just $1.35 billion.

Cyber rates increased by 2.5% on average during 2020, which Aon sees as corresponding to a period of time prior to insurers taking significant steps to address ransomware trends, including rate increases and underwriting actions later in 2020 and early 2021.

“Last year we said that we believe the next several years will be the proving ground for the cyber insurance thesis – that by putting a price on risk, insurers will help improve cybersecurity hygiene and reduce the cost of cyberattacks,” said Jon Laux, Aon’s Head of Cyber Analytics for Reinsurance Solutions.

“This remains true,” he added. “Insurers are pursuing many interesting tactics to address the claims environment, even as we see new developments opening in the threat environment. It’s a fascinating time in the industry. Stay tuned.”

Small Commercial Cyber Segment

Growth Rates and Loss Ratios

Aon’s report also took note of the continued development of the small commercial cyber segment, where both growth rates and loss ratios outperformed the rest of the industry.

“Although many have remarked on the impact of ransomware attacks on small businesses in 2020, the segment still ran at a lower loss ratio than the industry as a whole,” analysts said.

Understandably, insurers have found small businesses to be an attractive segment.

Loss ratios for the small commercial cohort averaged about 54.6% in 2020, while frequency for these insurers was 25% lower than industry averages, and severity was 26% lower as well.

Implications and Analysis

Industry-Wide Impact

Analysis of the implications of the ACORD application and the cyber insurance market developments.

How these trends may impact the insurance industry as a whole.

Potential opportunities and challenges for insurers and customers.

Strategic Considerations

Adapting to Industry Trends

How insurers can adapt to the changing cyber insurance landscape.

The importance of addressing ransomware trends and improving cybersecurity hygiene.

Strategies for insurers to stay competitive in the cyber insurance market.

Future Outlook

Projections and Insights

Projections for the future of the cyber insurance market and the impact of the ACORD application.

Potential opportunities and challenges for insurers and customers in the coming years.

Insights on the importance of staying informed and adapting to industry trends.

Conclusion

WTW’s Strategic Move: A Leap Forward in Insurance Technology

In a significant development, WTW (Willis Towers Watson) has appointed Mark Mamone as its new head of technology delivery and strategy, a move that underscores the firm’s commitment to innovation and digital transformation in the insurance industry. As discussed in our previous article, Mamone brings over two decades of experience in technology and insurance, with a proven track record of driving strategic growth and delivering cutting-edge solutions. His appointment is expected to bolster WTW’s ability to navigate the rapidly evolving insurance landscape, leveraging technology to enhance client experience, drive efficiency, and mitigate risks.

The significance of this appointment cannot be overstated, as it reflects WTW’s recognition of the critical role technology plays in shaping the future of the insurance industry. With Mamone at the helm, WTW is poised to capitalize on emerging trends, such as artificial intelligence, machine learning, and data analytics, to create new opportunities for growth and differentiation. As the industry continues to grapple with the challenges of digital disruption, WTW’s strategic move is a testament to the firm’s forward-thinking approach and its commitment to staying ahead of the curve.