HEADLINE: “Small Business, Big Burden: Local Entrepreneurs Bracing for a Potential Tax Hike” SUBHEADLINE: “A recent report from KPLC has left business owners in the region on edge, wondering how they’ll absorb the financial blow of a proposed tax increase. Will the benefits outweigh the costs, or will this hike be the nail in the coffin for many local businesses?”

As the backbone of our community, local businesses are the lifeblood of our economy, providing jobs, supporting local causes, and putting down roots in the very neighborhoods they serve. But now, a potential tax hike may be looming on the horizon, threatening the very survival of these entrepreneurial powerhouses. According to a recent report from KPLC, local business owners are bracing themselves for the financial implications of a tax increase, which could have far-reaching consequences for the local economy.

Impact of Potential Tax Hike on Local Businesses

A tax hike can have far-reaching implications for local businesses, and it’s essential to understand the potential effects on their operations and the local economy as a whole.

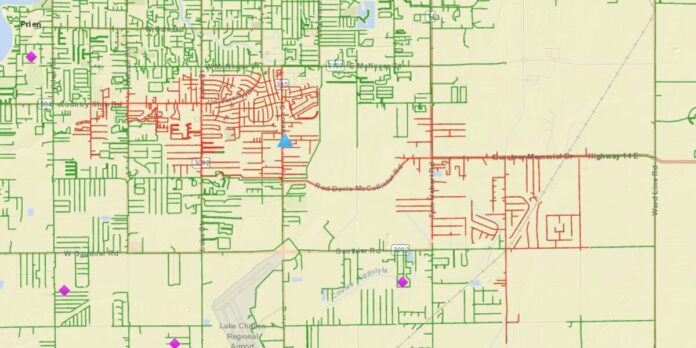

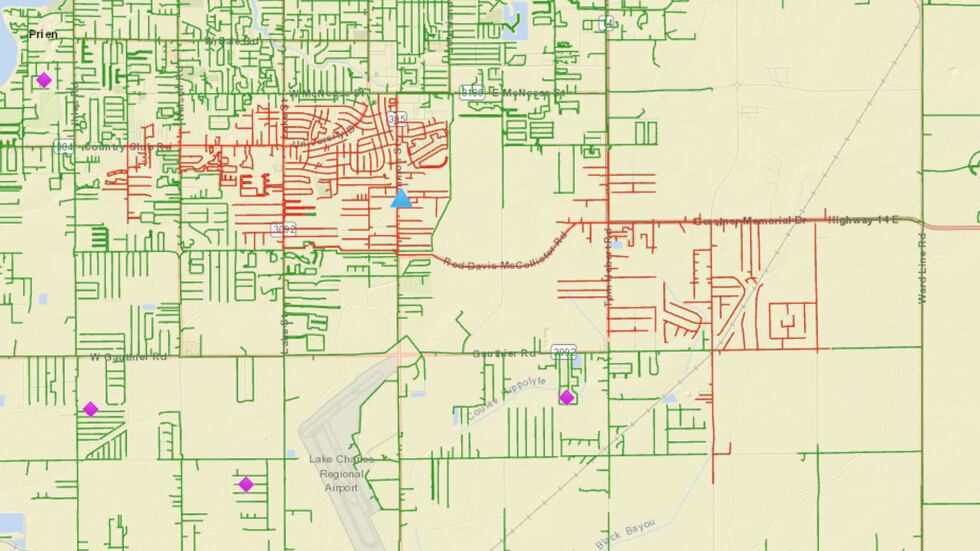

In the wake of the recent power outage in Lake Charles, local businesses are already facing significant challenges. According to Entergy, the outage, which affected around 6,400 customers, was caused by a malfunction at one of their substations. While Entergy has taken steps to rectify the situation, the impact on local businesses cannot be overstated.

Understanding the KPLC Situation

Power Outage and Its Aftermath

The power outage in Lake Charles had a significant impact on residents and local businesses alike. With over 6,000 customers affected, the outage resulted in lost productivity, revenue, and potentially even damaged equipment. While Entergy has apologized for the inconvenience and taken steps to prevent similar incidents in the future, local businesses are still reeling from the effects.

Causes and Effect on Local Businesses

The power outage was caused by a malfunction at one of Entergy’s substations. While the exact cause of the malfunction is still unknown, it’s clear that the outage had a significant impact on local businesses. With many businesses relying on electricity to operate, the outage resulted in lost revenue and productivity.

Entergy’s Response and Next Steps

Entergy has apologized for the inconvenience caused by the power outage and has taken steps to prevent similar incidents in the future. According to Entergy spokesperson Brandon Scardigli, the company is committed to providing reliable service to its customers and is working to identify the root cause of the malfunction. While the exact cause of the malfunction is still unknown, Entergy has assured customers that it is taking steps to prevent similar incidents in the future.

Economic Impact of Tax Hikes on Local Businesses

The Role of Sales Tax in Local Economies

Sales tax plays a critical role in local economies, providing revenue for local governments and supporting local businesses. In the case of the Buc-ee’s expansion into south Louisiana, the new travel center and gas station is expected to generate $1.5 million a year in local sales tax for the Lafayette area. However, with a potential tax hike on the horizon, local businesses may face increased pressure to maintain profitability.

Buc-ee’s Expansion into South Louisiana

Buc-ee’s expansion into south Louisiana is expected to bring significant economic benefits to the region. The new 74,000-square-foot travel center and gas station will include around 120 gas pumps and is expected to create jobs and stimulate economic growth. However, with a potential tax hike on the horizon, Buc-ee’s and other local businesses may face increased pressure to maintain profitability.

The Potential Tax Hike and Its Impact

A tax hike could have significant implications for local businesses, including Buc-ee’s. With a 2% sales tax already in place, a potential tax hike could result in increased costs for local businesses and potentially even higher prices for consumers. This could have a ripple effect throughout the local economy, impacting consumer spending and economic growth.

Practical Aspects of a Tax Hike

Preparing for a Potential Tax Increase

Local businesses can take steps to prepare for a potential tax hike. This includes reviewing financials, adjusting pricing strategies, and exploring cost-saving measures. By taking proactive steps, local businesses can mitigate the effects of a tax hike and maintain profitability.

The Impact on Small Businesses

Small businesses are often disproportionately affected by tax hikes. With limited resources and tight profit margins, small businesses may struggle to absorb increased costs. As a result, a tax hike could have a significant impact on small businesses, potentially even leading to closures.

The Role of Local Authorities in Mitigating the Effects

Local authorities play a critical role in mitigating the effects of a tax hike. By providing support and resources to local businesses, local authorities can help mitigate the impact of a tax hike. This could include offering tax incentives, providing training and education, and advocating for policies that support local businesses.

Analysis and Implications

The Long-Term Effects of Tax Hikes

The long-term effects of tax hikes on local businesses and the local economy cannot be overstated. With increased costs and potentially even higher prices for consumers, a tax hike could have a ripple effect throughout the local economy. This could impact consumer spending, economic growth, and even the overall competitiveness of the region.

The Impact on Consumer Spending

A tax hike could have a significant impact on consumer spending. With increased costs and potentially even higher prices for consumers, a tax hike could result in decreased consumer spending. This could have a ripple effect throughout the local economy, impacting businesses and economic growth.

The Potential for Economic Growth

Despite the potential challenges posed by a tax hike, there is still potential for economic growth in the region. By supporting local businesses, investing in infrastructure, and promoting economic development, local authorities can help stimulate economic growth and mitigate the effects of a tax hike.

Conclusion

In conclusion, the potential tax hike facing local businesses in the region, as reported by KPLC, is a pressing concern that warrants attention and action from stakeholders. The proposed increase in taxes could have far-reaching implications, including increased operational costs, reduced competitiveness, and potentially even business closures. As discussed in the article, the burden of this tax hike would disproportionately affect small and medium-sized enterprises, which are the lifeblood of our local economy.

The significance of this issue cannot be overstated. Local businesses are not only essential employers but also contribute to the unique character and fabric of our community. A tax hike of this nature would not only affect the bottom line of these businesses but also have a ripple effect on the entire local economy. Moreover, it is crucial to consider the broader implications of such a policy, including the potential for talent and investment to flee to more business-friendly regions.

As we move forward, it is essential for policymakers, business leaders, and community members to engage in a constructive dialogue about the future of our local economy. We must work together to find solutions that balance the need for revenue with the need to support and nurture our local businesses. As the fate of our local economy hangs in the balance, we must ask ourselves: what kind of community do we want to build, and what are we willing to do to support the entrepreneurs and innovators who call it home? The answer to this question will have a lasting impact on the future of our region, and it is a question that demands our attention and action today.