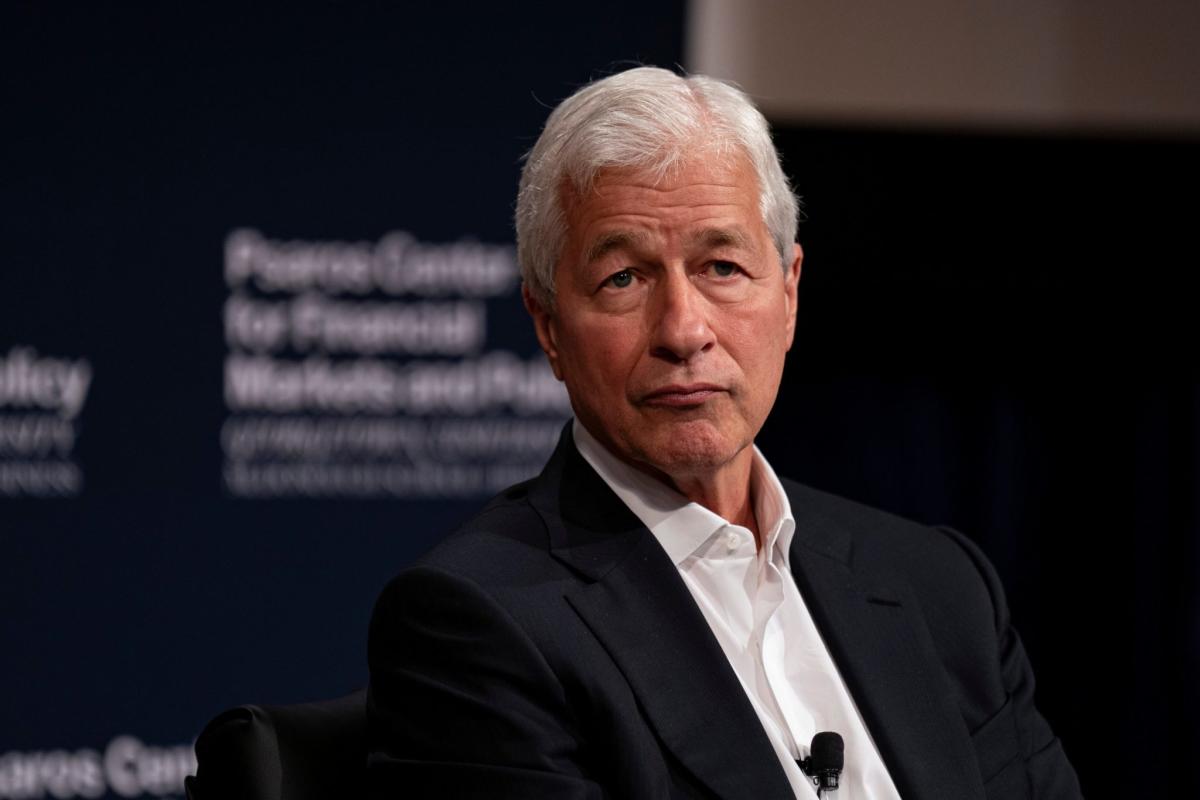

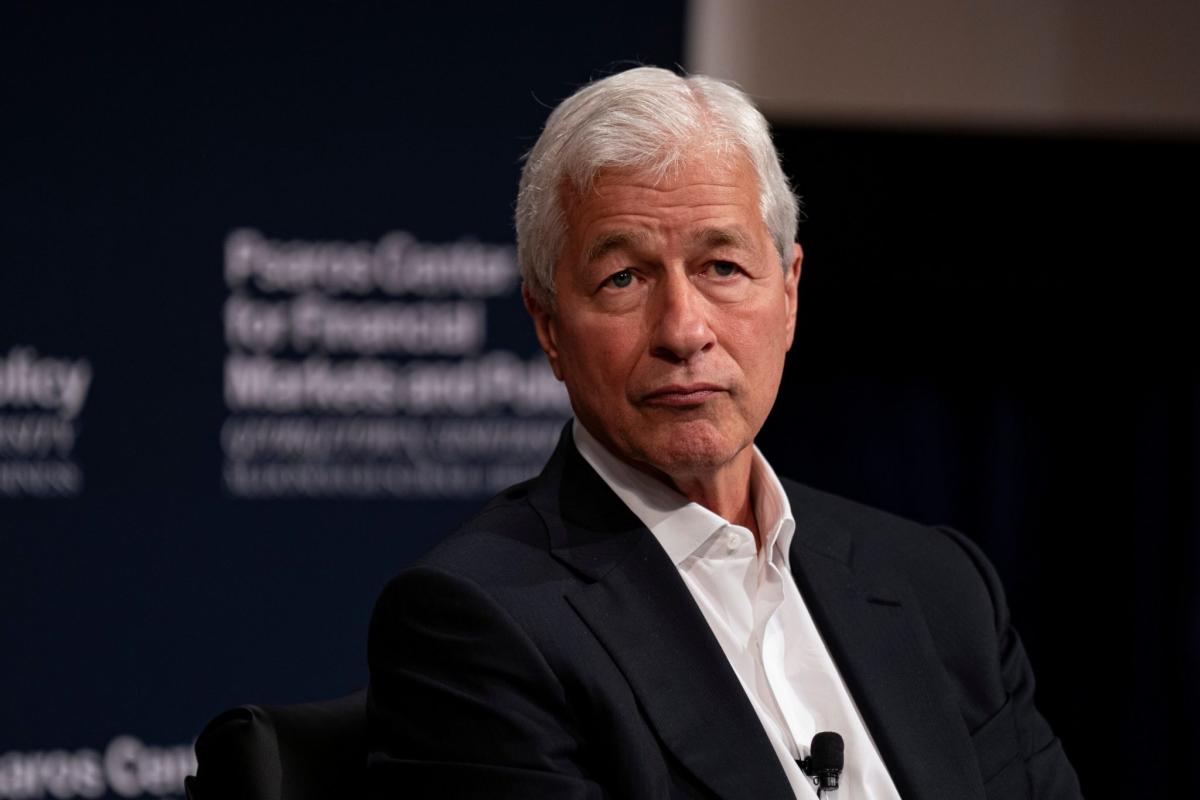

## Is Your MBA Making You Unethical? Jamie Dimon Thinks So You spent years grinding through case studies, networking events, and late nights cramming for exams. You landed your dream job at a prestigious firm like JPMorgan Chase. Now, you’re being tempted by the siren song of private equity, a lucrative path promising even bigger paychecks. But hold on – before you jump ship, consider this: JPMorgan CEO Jamie Dimon just called taking a private equity job while still employed at the bank “unethical.”

That’s right, the banking titan has thrown down the gauntlet, sparking a fiery debate about loyalty, ambition, and the very definition of ethical behavior in today’s cutthroat financial world.

What’s driving Dimon’s stance? Is he protecting his own interests, or is there a deeper ethical dilemma at play? Read on to explore the controversy and decide for yourself where you stand.The Broader Implications for the Financial Industry

Jamie Dimon’s stance against private equity poaching of junior bankers highlights a critical issue with broader implications for the financial industry. The practice, where private equity firms aggressively recruit newly minted graduates who are about to start at other institutions, raises serious ethical and operational concerns. This behavior not only undermines the trust and integrity of the financial sector but also creates a competitive disadvantage for banks that invest heavily in training their junior staff.

One of the most significant impacts is the potential loss of institutional knowledge. Junior bankers often undergo rigorous training and gain access to confidential information before leaving for private equity roles. This knowledge, once shared with competitors, can provide an unfair advantage. Dimon’s concern is not unfounded; the information these junior bankers possess can include sensitive client details, market strategies, and proprietary models, all of which are critical for a bank’s competitive edge.

Moreover, the practice of poaching creates a culture of instability and mistrust within financial institutions. Employees who feel they are being actively recruited by competitors may question their loyalty and commitment to their current employers. This can lead to a demotivated workforce, where employees are more focused on securing future opportunities rather than excelling in their current roles.

Additionally, the financial impact of poaching is substantial. Banks invest heavily in recruiting, training, and retaining talent. When a junior banker leaves prematurely, the institution loses not only the investment in their training but also the potential future contributions of these talented individuals. Studies have shown that the cost of replacing an employee can range from 50% to 200% of their annual salary, depending on the role and industry. For a bank, this financial burden can be significant, especially when it involves multiple high-potential juniors.

The ethical implications are equally concerning. Dimon’s reference to the practice as “unethical” underscores the moral dilemma faced by young professionals. They are often caught in a bind where they must choose between a job offer that may seem more lucrative or prestigious and the ethical responsibility to their current employer. This situation can lead to a erosion of trust and ethical integrity within the financial industry.

To address these issues, the financial industry needs to adopt a more collaborative approach to recruitment. Banks and private equity firms must work together to establish clear guidelines and ethical standards for hiring practices. This could include longer notice periods for job changes, stricter non-compete clauses, and more transparent communication about recruitment timelines. By fostering a culture of mutual respect and ethical behavior, the industry can create a more stable and trusting environment for young professionals.

Dimon’s Push to Eliminate the Practice

Dimon’s Intent to Eliminate Poaching

Jamie Dimon’s commitment to eliminating the practice of private equity poaching is not just a fleeting sentiment; it is a strategic move aimed at protecting JPMorgan Chase’s interests and maintaining the integrity of the financial industry. Dimon’s resolve to eliminate this practice, regardless of external opinions or the reactions of private equity firms, underscores his leadership style and his unwavering commitment to ethical business practices.

One of the key reasons Dimon is so adamant about eliminating this practice is the potential conflict of interest it creates. Junior bankers who accept jobs with private equity firms before they even start at JPMorgan are already in a position of conflict. They have access to confidential information and are being trained to perform specific tasks, all while negotiating with competitors. This conflict can lead to leaks of sensitive information and a loss of competitive advantage for JPMorgan.

Dimon’s stance is also about setting a precedent. By taking a firm stand against this practice, he sends a clear message to the industry about what is acceptable behavior. This can deter other firms from engaging in similar practices and encourage a more ethical approach to recruitment. Dimon’s decision to eliminate this practice, regardless of the potential backlash, demonstrates his leadership and his commitment to upholding the highest standards of integrity and trust within the financial industry.

The ethical implications of this practice are profound. Private equity firms, in Dimon’s view, are not mercenaries. They are expected to operate with a higher standard of ethics and integrity. By poaching junior bankers who are already employed or about to be employed by other firms, they are effectively undermining the trust and stability of the financial system. This behavior can erode the trust that clients place in financial institutions, leading to a less stable and less reliable financial system overall.

The Unfair Position for New Graduates

Dimon’s criticism of the practice also highlights the unfair position in which young graduates find themselves. The gap between the timing of job interviews and the actual start dates of new roles can be significant, often spanning years. This creates a situation where graduates are making critical career decisions with limited information and under considerable pressure.

For example, a graduate might accept a job offer from a private equity firm while still in the process of completing their final year of education. They may not even start their role for two years, during which time they are expected to perform their duties at their current employer. This creates a highly stressful situation where graduates must balance the demands of their current roles with the expectations of their future employers.

Dimon’s view on the unfairness of this situation is rooted in his experience and his understanding of the challenges faced by young professionals. He recognizes that graduates are often at a disadvantage, lacking the experience and knowledge to make fully informed decisions. The pressure to accept lucrative job offers from private equity firms can lead to rushed decisions that may not be in the best long-term interest of the graduate or the institution.

Moreover, the practice of poaching can create a culture of instability and mistrust among young professionals. Graduates may feel that their loyalty is constantly being tested, leading to a demotivated and disillusioned workforce. This can have long-term implications for the financial industry, as young professionals may become disillusioned with the sector and seek opportunities elsewhere.

To address this issue, Dimon advocates for a more collaborative approach to recruitment. Banks and private equity firms must work together to establish clear guidelines and ethical standards for hiring practices. This could include longer notice periods for job changes, stricter non-compete clauses, and more transparent communication about recruitment timelines. By fostering a culture of mutual respect and ethical behavior, the industry can create a more stable and trusting environment for young professionals.

The Broader Implications and Industry Response

The Shift in Banking Recruitment Practices

The practice of early recruitment by banks has been a contentious issue for some time. Traditionally, banks would begin the recruitment process for internships after a student’s junior year of college. However, this practice has shifted, with banks now starting the recruitment process much earlier. This shift has significant implications for both students and the institutions involved.

One of the main reasons for this shift is the competitive nature of the financial industry. Banks are vying for the best talent, and they are willing to invest heavily in recruitment to secure top graduates. This often means starting the recruitment process earlier and earlier, even before students have declared their majors. For example, some banks are now conducting on-campus interviews for first-year students, offering them internship opportunities that will not start until their junior year.

This shift in recruitment practices has led to a more intense and competitive environment for students. Graduates are now expected to navigate a complex and demanding recruitment process much earlier in their academic careers. This can be overwhelming, especially for students who are still exploring their interests and career paths. The pressure to secure an internship or a job offer early on can lead to rushed decisions and a lack of clarity about long-term career goals.

Moreover, the shift in recruitment practices has implications for the financial industry as a whole. The earlier onset of recruitment means that banks are investing more resources into the process, from on-campus interviews to recruitment events and networking opportunities. This investment can be substantial, and it is often justified by the need to secure the best talent. However, it also raises questions about the sustainability of these practices and the potential for creating a more competitive and less collaborative industry.

Dimon’s Advice to Young Professionals

Dimon’s stance on the poaching issue also underscores the importance of ethical decision-making for young professionals. He emphasizes that these professionals will face ethical dilemmas throughout their careers and must be prepared to make the right choices. Dimon’s advice to young professionals is clear: think for yourself and consider the fairness of the situation from the other side.

One of the key points Dimon makes is the need for young professionals to take responsibility for their actions. He believes that they must be aware of the ethical implications of their decisions and act accordingly. This includes considering the impact of their actions on their current employers, colleagues, and the industry as a whole. Dimon’s message is that ethical behavior is not just about following the rules; it is about doing what is right, even when it is not the easiest or most lucrative option.

Dimon’s advice also highlights the importance of empathy and understanding in the workplace. He encourages young professionals to put themselves in the shoes of others and consider the fairness of their actions. This perspective can help them make more informed and ethical decisions, even in complex and challenging situations. For example, a young professional considering a job offer from a private equity firm should think about the impact on their current employer and the potential for conflict of interest.

Moreover, Dimon’s advice is a call to action for young professionals to be proactive in addressing ethical issues. He believes that they have a role to play in shaping the culture and practices of the financial industry. By taking a stand against unethical behavior and advocating for more ethical practices, young professionals can help create a more trustworthy and stable financial system.

Assessing Reena Aggarwal’s Insights

Aggarwal’s Perspective on Early Recruitment

Reena Aggarwal, the founding director of the Psaros Center and Dimon’s interviewer, provided valuable insights into the shifting landscape of banking recruitment. She highlighted the need for policy changes to address the ethical and operational challenges posed by early recruitment practices. Aggarwal’s perspective underscores the complexity of the issue and the need for collaborative solutions.

Aggarwal’s observations align with Dimon’s concerns about the ethical implications of early recruitment. She points out that banks are now starting to interview undergraduates much earlier, even before they declare their majors. This trend raises questions about the readiness and preparedness of students to make informed career decisions at such an early stage. Aggarwal believes that this practice can lead to a lack of clarity about career goals and a rush to secure job offers, which may not be in the best long-term interest of the students.

Moreover, Aggarwal emphasizes the need for a more collaborative approach between schools and banks to address these issues. She suggests that institutions should work together to establish clear guidelines and ethical standards for recruitment. This could include longer notice periods for job changes, stricter non-compete clauses, and more transparent communication about recruitment timelines. By fostering a culture of mutual respect and ethical behavior, the industry can create a more stable and trusting environment for young professionals.

Dimon’s Response to Aggarwal

Dimon’s response to Aggarwal’s insights was a call to action. He agreed that new policies and procedures were necessary to address the ethical and operational challenges posed by early recruitment practices. Dimon emphasized the importance of collective action and collaboration between schools and banks to create a more ethical and stable recruitment environment.

One of the key points Dimon made was the need for a unified approach to address the issue. He believes that individual institutions cannot solve this problem alone; it requires a collective effort from the entire industry. Dimon’s call to action is for banks and schools to come together and develop policies that promote ethical behavior and fairness in recruitment.

Dimon’s response also underscores the importance of leadership in driving change. He recognizes that as a leader in the financial industry, he has a responsibility to set a precedent and advocate for ethical practices. By taking a firm stand against poaching and advocating for more ethical recruitment practices, Dimon is setting a positive example for the industry and encouraging others to follow suit.

The broader implications of Dimon’s stance and Aggarwal’s insights are significant. They highlight the need for a more ethical and collaborative approach to recruitment in the financial industry. By addressing the ethical and operational challenges posed by early recruitment practices, the industry can create a more stable and trusting environment for young professionals. This, in turn, can help to foster a more ethical and trustworthy financial system overall.

In conclusion, Dimon’s push to eliminate private equity poaching and his advocacy for more ethical recruitment practices are crucial steps towards addressing the broader implications for the financial industry. By taking a firm stand against unethical behavior and advocating for more ethical practices, Dimon is setting a positive example for the industry and encouraging others to follow suit. The collaborative effort between schools and banks to establish clear guidelines and ethical standards for recruitment is essential for creating a more stable and trusting environment for young professionals. Ultimately, the financial industry must prioritize ethical behavior and fairness in recruitment to build a more ethical and trustworthy system.

Conclusion

In a candid statement, JPMorgan CEO Jamie Dimon has sparked a contentious debate by labeling the practice of business school graduates taking private equity jobs while still employed at JPMorgan as “unethical.” At the heart of this issue lies a complex interplay between loyalty, career advancement, and the pursuit of lucrative opportunities. Dimon’s assertion raises essential questions about the responsibilities that come with being employed by a prominent financial institution, particularly when it involves sensitive client relationships and confidential information.

The implications of Dimon’s statement extend far beyond the realm of JPMorgan, as it touches on broader themes of professional integrity and the cutthroat nature of the finance industry. As the lines between employment and entrepreneurship continue to blur, the ethics surrounding job hopping and the poaching of talent will become increasingly relevant. Moreover, Dimon’s comments serve as a timely reminder that the choices we make in our careers have consequences that can impact not only our personal reputation but also the organizations we represent. As the finance industry continues to evolve, it is crucial that professionals prioritize transparency, loyalty, and a commitment to upholding the highest standards of integrity.