BREAKING: Leadership Shake-Up at IAC as Barry Diller’s Empire Undergoes Massive Transformation In a surprise move that sent shockwaves through the corporate world, the CEO of Barry Diller’s IAC (InterActiveCorp) has stepped down from their position. This high-profile departure comes as the company embarks on a significant restructuring effort, announcing a major spinoff of its stake in Angi, the popular home services platform. As the dust settles, one thing is clear: this seismic shift will have far-reaching implications for the future of IAC and its diverse portfolio of brands. In this exclusive article, we’ll delve into the details behind this leadership change and explore what it means for the company’s trajectory ahead. Stay tuned for a closer look at the evolving landscape of IAC and the strategic decisions driving its transformation.

IAC’s Transformation: Joey Levin Steps Down as CEO

In a significant move, Joey Levin, the CEO of Barry Diller’s IAC, has stepped down as the company’s CEO, marking a new chapter in the company’s transformation. Levin, who has been instrumental in shaping IAC’s growth and expansion, will take on the role of Executive Chairman of Angi, the home services platform that is being spun off by IAC.

Levin’s departure as CEO comes as IAC prepares to spin off its full stake in Angi to IAC shareholders. The spin-off, which is expected to be tax-free, will allow IAC shareholders to directly own Angi, resulting in IAC and Angi becoming wholly separate entities.

Leadership Shift and Spinoff Details

Joey Levin’s New Role as Executive Chairman of Angi

In his new role, Levin will serve as Angi’s senior executive, working closely with CEO Jeff Kip to shape the company’s future. Despite Levin’s departure as CEO, he will continue to be involved with IAC as an advisor, providing guidance and insights to the company’s leadership team.

Levin’s appointment as Executive Chairman of Angi is seen as a significant move, as it will allow him to focus on the growth and development of the company, without the constraints of being part of a larger conglomerate.

Angi CEO Jeff Kip’s Continued Leadership

Jeff Kip, the current CEO of Angi, will continue to lead the company, working closely with Levin and the Angi Board of Directors. Kip’s leadership has been instrumental in shaping Angi’s growth and expansion, and his continued involvement will ensure a smooth transition for the company.

Kip’s leadership team will also continue to work closely with Levin, who will provide guidance and support as the Executive Chairman of Angi.

IAC’s Rearranged Leadership Structure

Following Levin’s departure as CEO, IAC’s leadership structure will undergo a significant change. Christopher Halpin, IAC’s Chief Financial Officer and Chief Operating Officer, and Kendall Handler, IAC’s Chief Legal Officer, will report directly to Barry Diller, IAC’s Senior Executive and Chairman.

This rearranged leadership structure will allow Diller to take a more active role in leading IAC, while also providing a clear line of succession for the company’s leadership team.

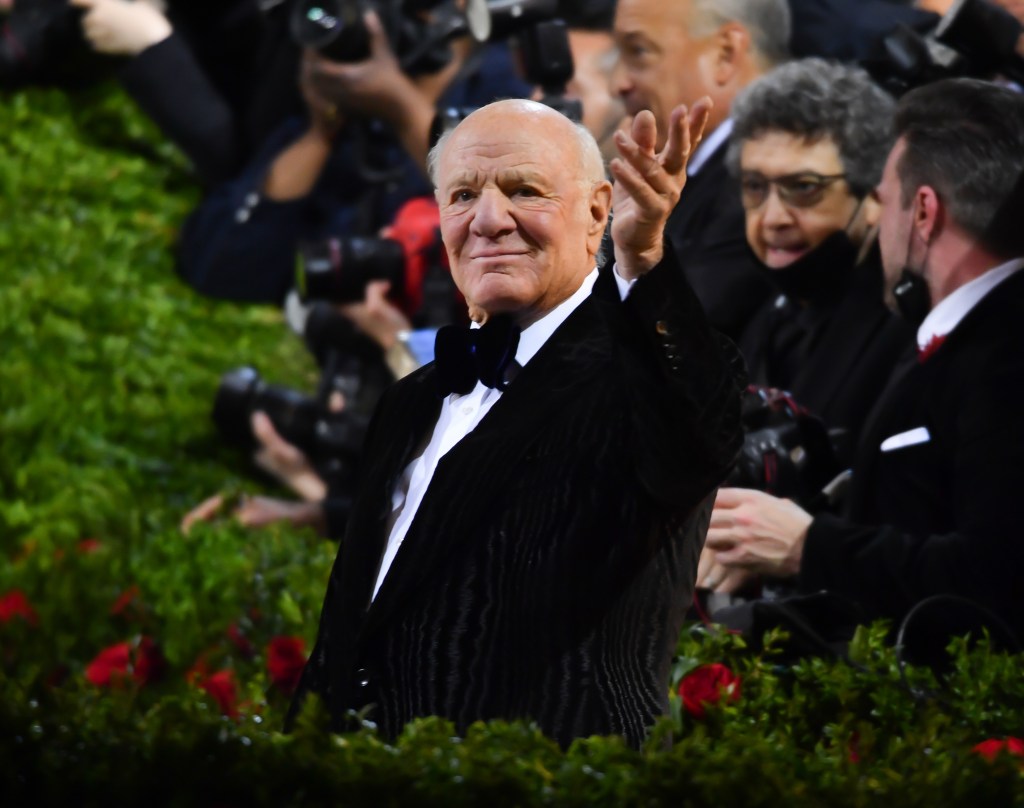

Barry Diller’s Reaffirmed Central Role

CEO Diller’s Statement on Joey Levin’s Departure

Barry Diller, IAC’s Senior Executive and Chairman, has reaffirmed his central role in leading the company, following Levin’s departure as CEO. Diller has expressed his gratitude to Levin for his service and leadership, while also emphasizing his own commitment to IAC’s future growth and success.

“Joey Levin has been an exemplary leader of IAC, creating significant value during his nearly decade-long tenure as IAC CEO,” said Diller. “I am confident that he will continue to be a valuable advisor to IAC, and I look forward to working with him in his new role as Executive Chairman of Angi.”

Diller’s Reorganization of IAC’s Leadership

Diller’s reorganization of IAC’s leadership will allow him to take a more active role in leading the company, while also providing a clear line of succession for the company’s leadership team.

This rearranged leadership structure will also enable IAC to focus on its broader portfolio, while also providing more flexibility for the company’s leadership team to make strategic decisions.

Implications of Diller’s Enhanced Leadership Role

Diller’s enhanced leadership role will have significant implications for IAC’s future growth and success. As the company’s Senior Executive and Chairman, Diller will be responsible for guiding IAC’s strategy and direction, while also providing leadership and guidance to the company’s leadership team.

This will allow IAC to benefit from Diller’s extensive experience and expertise, while also providing a clear line of succession for the company’s leadership team.

Spinoff and Its Consequences

Tax-Free Spinoff of Angi Stake to IAC Shareholders

The spinoff of IAC’s full stake in Angi to IAC shareholders will be tax-free, allowing shareholders to directly own Angi, resulting in IAC and Angi becoming wholly separate entities.

This will provide IAC shareholders with a direct ownership stake in Angi, while also allowing IAC to focus on its broader portfolio and growth opportunities.

IAC’s Simplified Structure and Enhanced Growth Opportunities

The spinoff will allow IAC to simplify its structure, while also providing the company with enhanced growth opportunities.

IAC will be able to focus on its broader portfolio, while also providing more flexibility for the company’s leadership team to make strategic decisions.

IAC’s Ability to Use Stock for Acquisitions and Incentives

The spinoff will also allow IAC to use its stock more effectively, whether for acquisitions or to incentivize employees.

This will provide IAC with more flexibility to achieve its strategic objectives, while also providing a more attractive equity currency to accelerate growth.

Angi’s Future as an Independent Entity

Enhanced Focus on Home Services and Growth

As an independent entity, Angi will be able to focus on its home services platform, while also accelerating its growth and expansion.

Angi will have more flexibility to make strategic decisions, while also being able to allocate its resources more effectively to meet the needs of its business.

Streamlined Decision-Making and Resource Allocation

Angi’s independence will also allow it to streamline its decision-making process, while also allocating its resources more effectively to meet the needs of its business.

This will provide Angi with more flexibility to achieve its strategic objectives, while also providing a more attractive equity currency to accelerate growth.

IAC’s Retention of Angi’s High-Vote Shares and Dual-Class Structure

IAC will retain Angi’s high-vote shares, while also eliminating Angi’s dual-class structure.

This will allow IAC to maintain its influence over Angi, while also providing Angi with more flexibility to make strategic decisions.

Impact on IAC and Angi Shareholders

Share Price Increase Following the Announcement

The announcement of the spinoff has led to an increase in IAC’s share price, reflecting the market’s positive response to the deal.

This increase in share price will benefit IAC shareholders, while also providing a more attractive equity currency to accelerate growth.

Implications for IAC Shareholders Direct Ownership of Angi

The spinoff will provide IAC shareholders with direct ownership of Angi, allowing them to benefit from Angi’s growth and expansion.

This will provide IAC shareholders with a more direct stake in Angi, while also allowing them to benefit from Angi’s increased flexibility and growth opportunities.

Potential Benefits and Drawbacks for Both Companies’ Valuations

The spinoff will have both positive and negative implications for the valuations of both IAC and Angi.

The increased flexibility and growth opportunities provided by the spinoff will likely lead to an increase in Angi’s valuation, while also benefiting IAC’s share price.

However, the spinoff may also lead to a decrease in IAC’s valuation, as the company will be separating from its most valuable asset.

Practical Considerations and Future Outlook

IAC’s Ability to Focus on Broader Portfolio and Growth

The spinoff will allow IAC to focus on its broader portfolio, while also providing the company with more flexibility to achieve its strategic objectives.

This will enable IAC to accelerate its growth and expansion, while also providing a more attractive equity currency to accelerate growth.

Angi’s Potential Benefits from Independent Status and Enhanced Capital Structure

Angi’s independence will provide the company with more flexibility to make strategic decisions, while also allocating its resources more effectively to meet the needs of its business.

This will enable Angi to accelerate its growth and expansion, while also providing a more attractive equity currency to accelerate growth.

Implications for IAC’s Future Mergers and Acquisitions

The spinoff will have significant implications for IAC’s future mergers and acquisitions, as the company will be able to use its stock more effectively to achieve its strategic objectives.

This will provide IAC with more flexibility to make strategic decisions, while also allocating its resources more effectively to meet the needs of its business.

Conclusion

A New Era for IAC: Leadership Transition and Strategic Shift

As we conclude our analysis of the recent developments at Barry Diller’s IAC, it’s clear that the company is undergoing a significant transformation. The announcement of CEO Robert Grimmond’s departure marks a pivotal moment in IAC’s history, as the company embarks on a new chapter with a spinoff of its Angi stake. Our article delved into the key points surrounding this transition, highlighting the strategic reasons behind the spinoff, the implications for IAC’s portfolio companies, and the significance of Grimmond’s departure. We also explored the potential benefits of this move, including the ability to unlock value and create new opportunities for growth.

The spinoff of Angi’s stake is a critical step in IAC’s efforts to refocus its strategy and create a more streamlined organization. This move will allow IAC to concentrate on its core businesses and explore new areas of growth, while also providing Angi with the autonomy to pursue its own vision and goals. The implications of this transition are far-reaching, with potential benefits for both IAC and Angi. As the company continues to navigate this new landscape, it’s likely that we’ll see increased innovation, investment, and growth across its portfolio of companies.