“Blackstone Weighs Small Stake in TikTok – The Battle for Social Media Supremacy Intensifies” In a move that’s sending shockwaves through the tech and finance worlds, Blackstone Group, one of the world’s largest private equity firms, is reportedly considering a small investment in TikTok – the rapidly evolving social media giant that’s captivated the attention of billions. As TikTok continues to challenge the dominance of established players like Instagram and YouTube, Blackstone’s potential foray into the company is sparking a heated debate about the future of online content creation, user data, and the very fabric of social media itself. With the stakes higher than ever, we’ll delve into the implications of this development and explore the strategic implications for Blackstone, TikTok, and the broader tech ecosystem. Will this investment be a savvy move to stay ahead of the curve, or a costly misstep?

Market Valuation and Geopolitical Factors

A deal with Microsoft or other bidders could propel TikTok’s valuation to as high as $80 billion, making it a significant player in the tech industry. This valuation is a result of the company’s massive user base and its potential for growth in the global market. However, the situation is complicated by the complex relationship between the U.S. and China, with tensions and trade wars influencing the outcome of the deal. The U.S. government has expressed concerns over TikTok’s Chinese ties, citing national security threats, and has ordered the company to sell its U.S. operations or cease operating in the country.

The geopolitical factors at play have made the deal a challenging one to navigate. The U.S. government’s concerns over TikTok’s Chinese ownership have led to a situation where the company is being forced to consider selling its U.S. operations. This has resulted in a number of potential bidders, including Microsoft, Oracle, and other private equity firms, expressing interest in acquiring the company. The situation highlights the need for companies to navigate complex regulatory environments, with implications for businesses operating in multiple countries and jurisdictions.

Private Equity Involvement

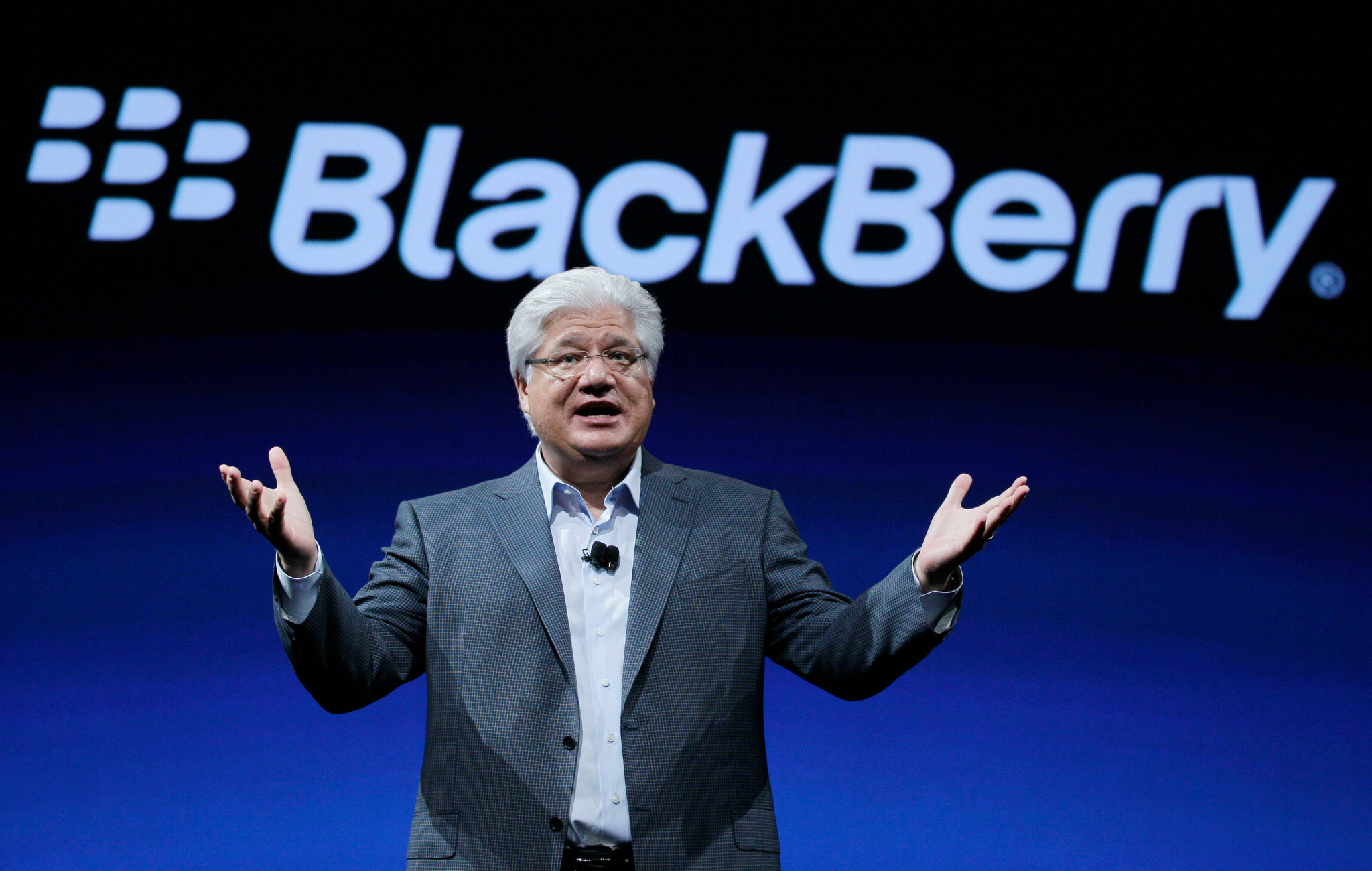

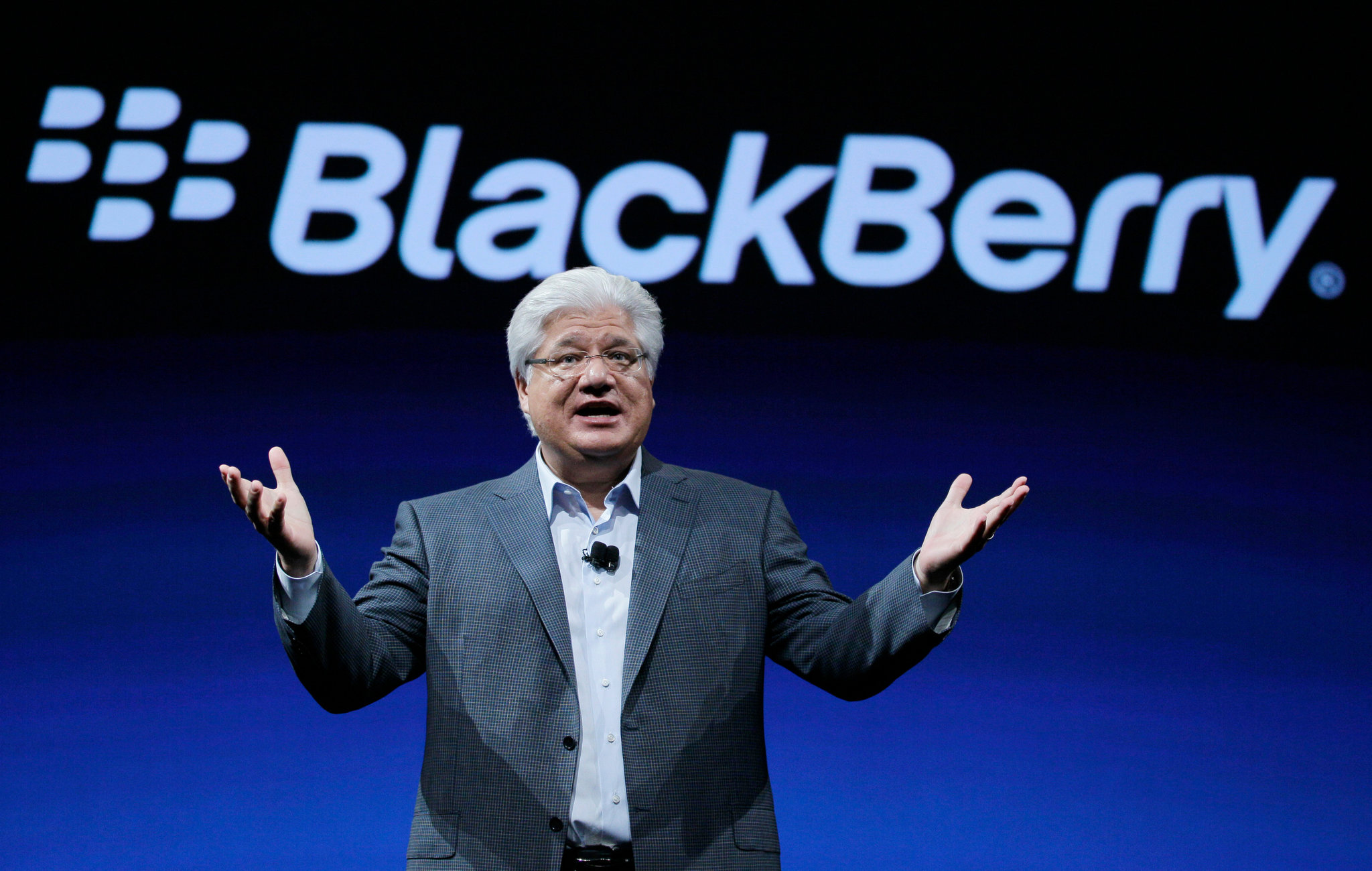

Blackstone and other private equity firms are exploring potential bids for TikTok or other companies, such as BlackBerry, highlighting the role of private equity in shaping the tech industry. Private equity firms have been considering a bid for BlackBerry for more than a year, with Mike Lazaridis, the co-founder of BlackBerry, reaching out to private equity firms about a possible bid for the troubled company. The potential of any effort to take BlackBerry private was muddied further by the company’s quarterly revenue, which was far below analyst expectations.

The involvement of private equity firms in the tech industry is not new, but the current situation highlights the significant role they play in shaping the industry. Private equity firms have the resources and expertise to acquire and turn around troubled companies, and their involvement in the tech industry can have significant implications for the companies and their stakeholders. In the case of TikTok, the involvement of private equity firms could result in the company being acquired by a U.S.-based firm, which could help to alleviate concerns over the company’s Chinese ties.

Practical Aspects and Future Directions

A deal with Microsoft could lead to TikTok adopting Azure cloud computing services, making it one of Microsoft’s largest cloud clients. This would be a significant win for Microsoft, as it would provide the company with a major client for its cloud computing services. For TikTok, a deal with Microsoft could help to alleviate concerns over the company’s Chinese ties, as it would provide the company with a U.S.-based partner with significant resources and expertise.

The adoption of Azure cloud computing services by TikTok could also have significant implications for the company’s operations. The use of cloud computing services could help to improve the company’s efficiency and scalability, allowing it to better serve its users and expand its operations. Additionally, the use of Azure cloud computing services could help to improve the company’s security, as Microsoft has significant resources and expertise in the area of cybersecurity.

Cloud Computing Services

The use of cloud computing services is becoming increasingly common in the tech industry, as companies look to improve their efficiency and scalability. Cloud computing services provide companies with the ability to store and process data remotely, allowing them to reduce their IT infrastructure costs and improve their flexibility. The use of cloud computing services also provides companies with access to significant resources and expertise, allowing them to better serve their users and expand their operations.

In the case of TikTok, the use of cloud computing services could help to improve the company’s operations and alleviate concerns over its Chinese ties. The adoption of Azure cloud computing services by TikTok could provide the company with a U.S.-based partner with significant resources and expertise, helping to improve the company’s efficiency, scalability, and security. Additionally, the use of cloud computing services could help to reduce the company’s IT infrastructure costs, allowing it to invest in other areas of its business.

Regulatory Environment

The situation highlights the need for companies to navigate complex regulatory environments, with implications for businesses operating in multiple countries and jurisdictions. The U.S. government’s concerns over TikTok’s Chinese ties have resulted in a situation where the company is being forced to consider selling its U.S. operations. This has resulted in a number of potential bidders, including Microsoft, Oracle, and other private equity firms, expressing interest in acquiring the company.

The regulatory environment for tech companies is becoming increasingly complex, with governments around the world imposing significant regulations on the industry. The General Data Protection Regulation (GDPR) in the European Union, the California Consumer Privacy Act (CCPA) in the United States, and the Cybersecurity Law in China are just a few examples of the significant regulations that tech companies must navigate. The situation highlights the need for companies to have a deep understanding of the regulatory environment and to be able to navigate complex regulatory requirements.

Expert Analysis and Insights

According to experts, the situation highlights the significant challenges that tech companies face in navigating complex regulatory environments. “The regulatory environment for tech companies is becoming increasingly complex, with governments around the world imposing significant regulations on the industry,” said one expert. “Companies must have a deep understanding of the regulatory environment and be able to navigate complex regulatory requirements in order to succeed.”

Experts also note that the situation highlights the significant role that private equity firms play in shaping the tech industry. “Private equity firms have the resources and expertise to acquire and turn around troubled companies, and their involvement in the tech industry can have significant implications for the companies and their stakeholders,” said another expert. “In the case of TikTok, the involvement of private equity firms could result in the company being acquired by a U.S.-based firm, which could help to alleviate concerns over the company’s Chinese ties.”

Real-World Applications and Examples

The situation highlights the significant challenges that tech companies face in navigating complex regulatory environments. The use of cloud computing services, such as Azure, can help to improve a company’s efficiency and scalability, while also providing access to significant resources and expertise. The adoption of Azure cloud computing services by TikTok could provide the company with a U.S.-based partner with significant resources and expertise, helping to improve the company’s efficiency, scalability, and security.

Other examples of companies that have successfully navigated complex regulatory environments include Microsoft, which has invested heavily in its cloud computing services, and Amazon, which has expanded its operations into a number of new areas, including advertising and artificial intelligence. These companies have demonstrated an ability to navigate complex regulatory requirements and to adapt to changing market conditions, and have been rewarded with significant growth and success.

Key Takeaways

The situation highlights the significant challenges that tech companies face in navigating complex regulatory environments. The use of cloud computing services, such as Azure, can help to improve a company’s efficiency and scalability, while also providing access to significant resources and expertise. The adoption of Azure cloud computing services by TikTok could provide the company with a U.S.-based partner with significant resources and expertise, helping to improve the company’s efficiency, scalability, and security.

- The regulatory environment for tech companies is becoming increasingly complex, with governments around the world imposing significant regulations on the industry.

- Companies must have a deep understanding of the regulatory environment and be able to navigate complex regulatory requirements in order to succeed.

- Private equity firms have the resources and expertise to acquire and turn around troubled companies, and their involvement in the tech industry can have significant implications for the companies and their stakeholders.

Conclusion

Conclusion: The Evolving Landscape of Global Tech Investments

As reported by The New York Times, Blackstone, a prominent private equity firm, is considering a small investment in TikTok, the popular social media platform. This development underscores the increasingly complex dynamics of global tech investments, where traditional players are now venturing into the digital sphere. The article highlights the key points, including Blackstone’s potential investment, the involvement of its executives, and the platform’s ongoing struggles with regulatory scrutiny. Moreover, it sheds light on the challenges faced by global tech giants in navigating the intricate web of international regulations and cultural sensitivities.

The significance of this development lies in its implications for the future of global tech investments. As the tech landscape continues to evolve, it is likely that we will see more traditional players, like Blackstone, entering the fray. This could lead to a more diverse and dynamic investment landscape, with new opportunities for growth and innovation. However, it also raises concerns about the potential for increased regulatory scrutiny and the need for greater cultural sensitivity in global tech investments.