AMD’s Gaming Conundrum: Can the Chipmaker Rebound in 2024?

As the world of gaming continues to evolve at breakneck speed, one of the industry’s stalwart players, AMD, finds itself at a crossroads. According to a recent report from The Motley Fool, AMD’s struggling gaming business could be poised to take another hit this year. The prospect is alarming, given the company’s already-challenged market share and the intense competition from industry giants like NVIDIA.

The Struggling Gaming Business of AMD: A Crucial Year Ahead

Advanced Micro Devices (AMD) has been a stalwart in the technology industry for decades, with its gaming division being a significant contributor to its overall revenue. However, recent earnings have shown a decline in revenue growth, which has raised concerns among investors. In this article, we will delve into the struggles of AMD’s gaming business and explore the opportunities and challenges that lie ahead.

AMD’s Gaming Division Stumbles

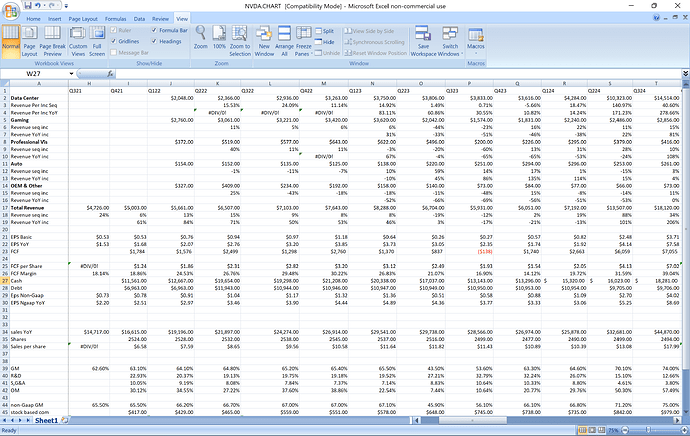

The first quarter of 2024 saw a significant decline in revenue growth for AMD’s gaming segment, with a 48% drop in revenue. This decline is a major concern for the company, as it has been a significant contributor to its overall revenue. The gaming division has been struggling to compete with market leader Nvidia, which has a 90% market share in AI GPUs.

A comparison of AMD’s gaming segment revenue growth to Nvidia’s dominance in the market is telling. In the first quarter of 2024, Nvidia’s revenue skyrocketed 262%, beating Wall Street expectations by more than $1 billion. This significant growth is a testament to Nvidia’s dominance in the AI chip market and its ability to capitalize on the growing demand for GPUs.

The impact of this decline on AMD’s stock price has been modest, with a 1% increase in stock price since the earnings release. This lack of excitement among investors is a concern for the company, as it needs to drive growth and revenue to justify its stock price.

The Rise of AI Chips: A New Era for AMD

AMD has been working to develop new AI chips, including the MI325X accelerator, which is scheduled for release in Q4 2024. This new chip design is part of AMD’s shift to a yearly release cycle, which could help the company stay competitive in the market.

The possibility of AMD capturing a significant market share in the AI chip sector is a tantalizing prospect. If AMD can break through Nvidia’s 90% market share in AI GPUs, it could drive future growth and revenue for the company.

AMD’s Competitors in the AI Chip Market

Nvidia’s dominance in the AI chip market is a significant challenge for AMD. With a 90% market share in AI GPUs, Nvidia is the clear leader in the market. However, AMD is not giving up and has been working to develop new AI chips to compete with Nvidia.

Intel is also expanding its chip manufacturing capabilities, which could make it a significant player in the AI chip market. This expansion could allow Intel to profit from the growing demand for AI chips and potentially become the go-to manufacturer for many companies.

The Financial Performance of AMD: A Mixed Bag

AMD’s financial performance has been a mixed bag in recent quarters. While the company has beaten analyst expectations in terms of earnings, its revenue growth has been disappointing.

Earnings Per Share (EPS) and Revenue Growth

In the first quarter of 2024, AMD beat analyst expectations with EPS of $0.62 and revenue of $5.5 billion. However, the company’s revenue growth was a fraction of Nvidia’s 262% increase in the same quarter.

The modest increase in EPS and revenue growth has not been enough to boost investor confidence in the stock. The company’s stock has struggled against comparisons to Nvidia, which has dominated the AI chip market.

Free Cash Flow and Investing in the Business

AMD’s free cash flow has declined by 37% in the last 12 months, making it challenging for the company to invest in its business. This decline in free cash flow is a concern for investors, as it could impact the company’s ability to drive future growth and revenue.

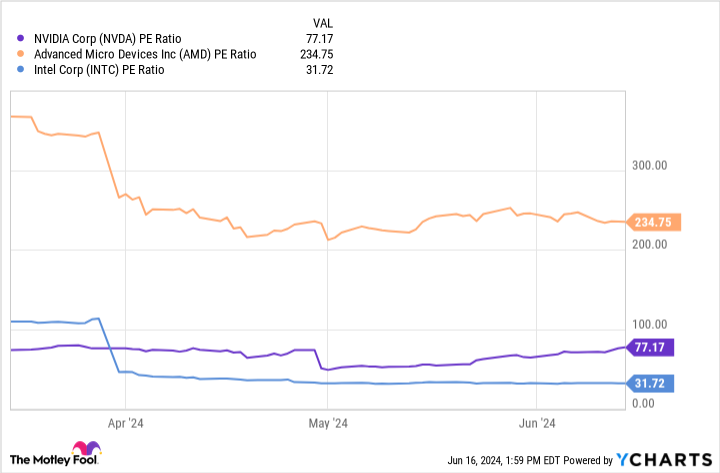

Valuation Metrics: A Comparison with Nvidia and Intel

AMD’s higher P/E ratio compared to Nvidia and Intel makes its stock less attractive to investors. The lower P/E ratio of Nvidia and Intel could make their stocks more appealing to investors compared to AMD.

The Future of AMD: Opportunities and Challenges Ahead

AMD’s future is uncertain, with both opportunities and challenges ahead. The company has been working to develop new AI chips, which could drive future growth and revenue.

Capturing Market Share in AI Chips

The possibility of AMD capturing a significant market share in the AI chip sector is a tantalizing prospect. If AMD can break through Nvidia’s 90% market share in AI GPUs, it could drive future growth and revenue for the company.

However, breaking through Nvidia’s dominance in the AI chip market will be a significant challenge for AMD. The company will need to invest heavily in research and development to develop new AI chips that can compete with Nvidia’s offerings.

Expansion into New Markets

AMD has been expanding into new markets, including automotive chips and cell phones. This expansion could provide opportunities for growth and revenue for the company.

However, expanding into new markets will require AMD to adapt to new market dynamics and competition. The company will need to invest in research and development to develop new products and technologies that can compete with existing players in these markets.

Investor Confidence and Stock Price

The recent earnings results have not instilled much confidence in AMD’s stock price. The company’s stock has struggled against comparisons to Nvidia, which has dominated the AI chip market.

The potential for AMD’s stock price to increase if the company can drive future growth and capture market share in the AI chip sector is a tantalizing prospect. However, the company will need to invest heavily in research and development to develop new AI chips that can compete with Nvidia’s offerings.

Conclusion

AMD’s future is uncertain, with both opportunities and challenges ahead. The company has been working to develop new AI chips, which could drive future growth and revenue.

However, breaking through Nvidia’s dominance in the AI chip market will be a significant challenge for AMD. The company will need to invest heavily in research and development to develop new AI chips that can compete with Nvidia’s offerings.

Expansion into new markets could provide opportunities for growth and revenue for the company. However, expanding into new markets will require AMD to adapt to new market dynamics and competition.

The recent earnings results have not instilled much confidence in AMD’s stock price. The company’s stock has struggled against comparisons to Nvidia, which has dominated the AI chip market.

The potential for AMD’s stock price to increase if the company can drive future growth and capture market share in the AI chip sector is a tantalizing prospect. However, the company will need to invest heavily in research and development to develop new AI chips that can compete with Nvidia’s offerings.

Conclusion

Conclusion: AMD’s Gaming Business at a Crossroads

In “AMD’s Struggling Gaming Business Could Take Another Hit This Year” from The Motley Fool, we dove into the complexities of AMD’s (Advanced Micro Devices) gaming business, which has been facing significant challenges in recent years. The article highlighted several key points, including AMD’s decline in market share, the rise of NVIDIA, and the company’s struggles to compete in the lucrative gaming market. Moreover, the article discussed the impact of COVID-19 on the gaming industry, as well as AMD’s efforts to increase its presence in the gaming market through strategic partnerships and new product releases. The article also emphasized the importance of AMD’s ability to innovate and adapt to changing market conditions to stay competitive.

The significance of this topic cannot be overstated, as the gaming industry is a multi-billion-dollar market that continues to grow in popularity. AMD’s struggles in this space have significant implications for the company’s overall financial performance and investor confidence. Furthermore, the competition between AMD and NVIDIA has far-reaching consequences for the wider technology industry, with potential impacts on everything from cloud computing to artificial intelligence. As we look ahead to the future, it’s clear that AMD will need to make significant strides to regain its footing in the gaming market and stay competitive with NVIDIA.

In conclusion, AMD’s gaming business is at a crossroads, and the company faces a critical juncture in its efforts to regain market share and stay competitive. As investors and fans alike, we can’t help but wonder: will AMD rise to the challenge and reclaim its spot as a leader in the gaming market, or will it continue to struggle in the shadows of NVIDIA? One thing is certain: the future of AMD’s gaming business will be shaped by its ability to innovate, adapt, and execute in the face of intense competition.